Tally Invoice Excel Format Free Download | GST Billing Template

What is Tally Bill Format ?

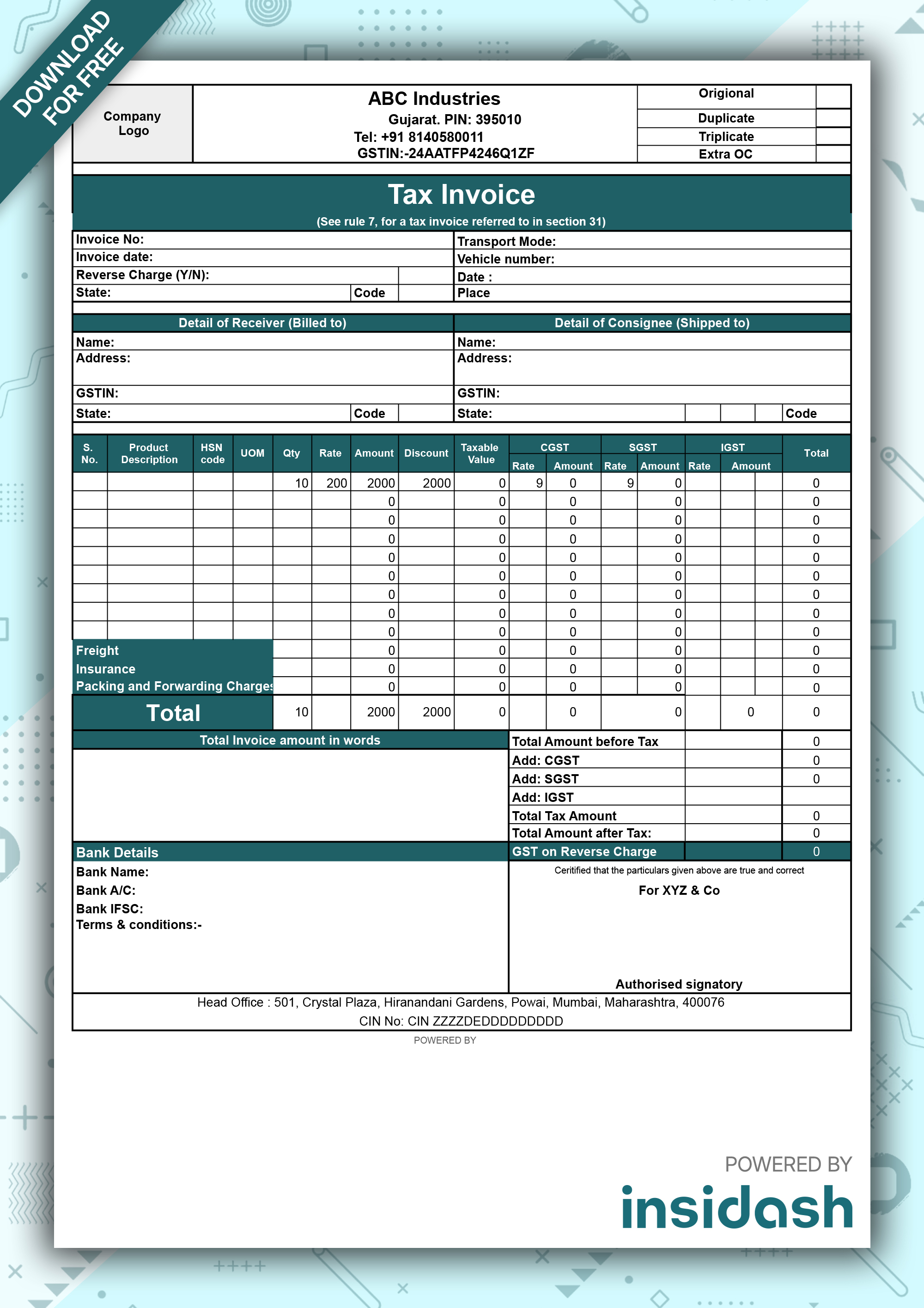

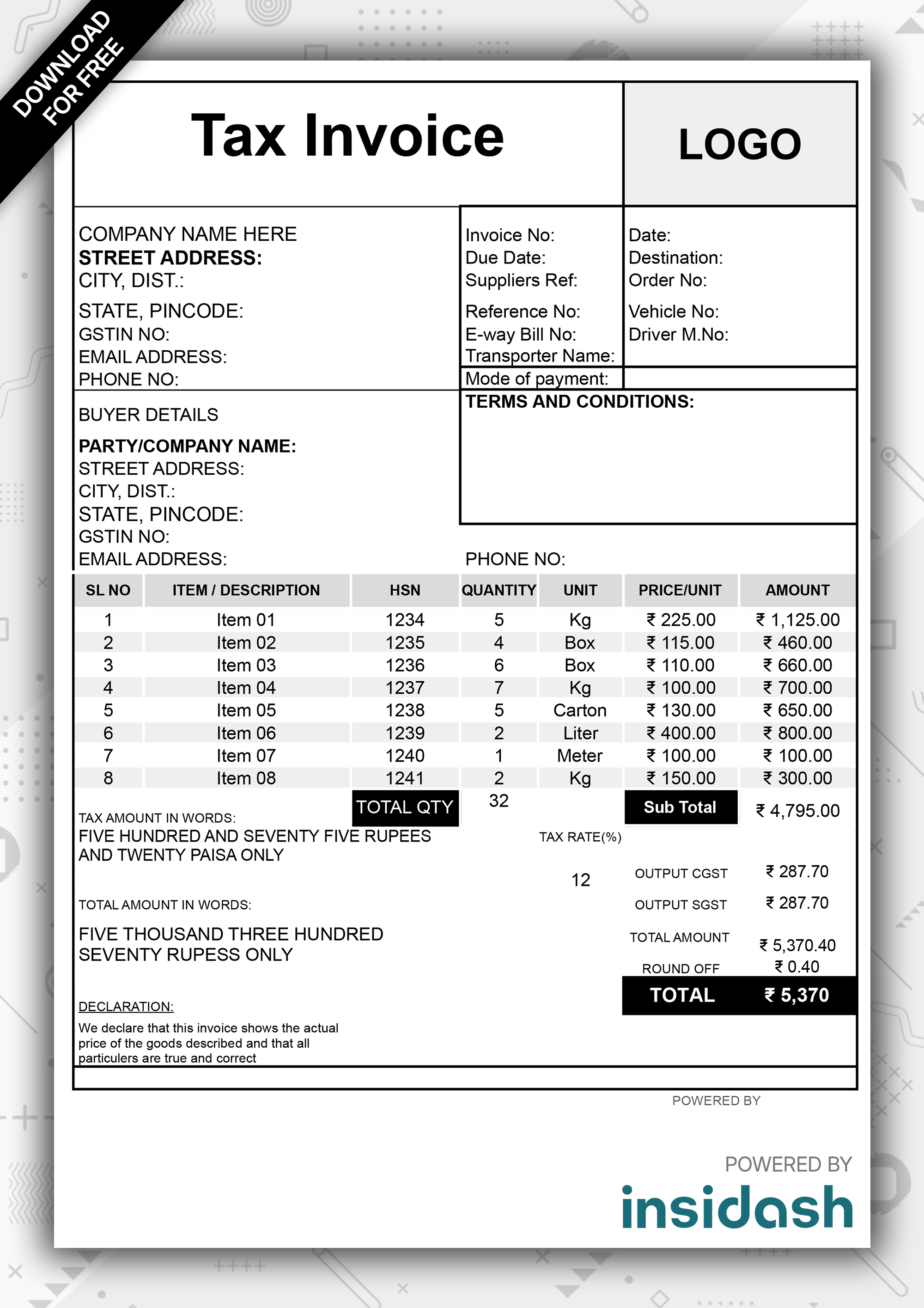

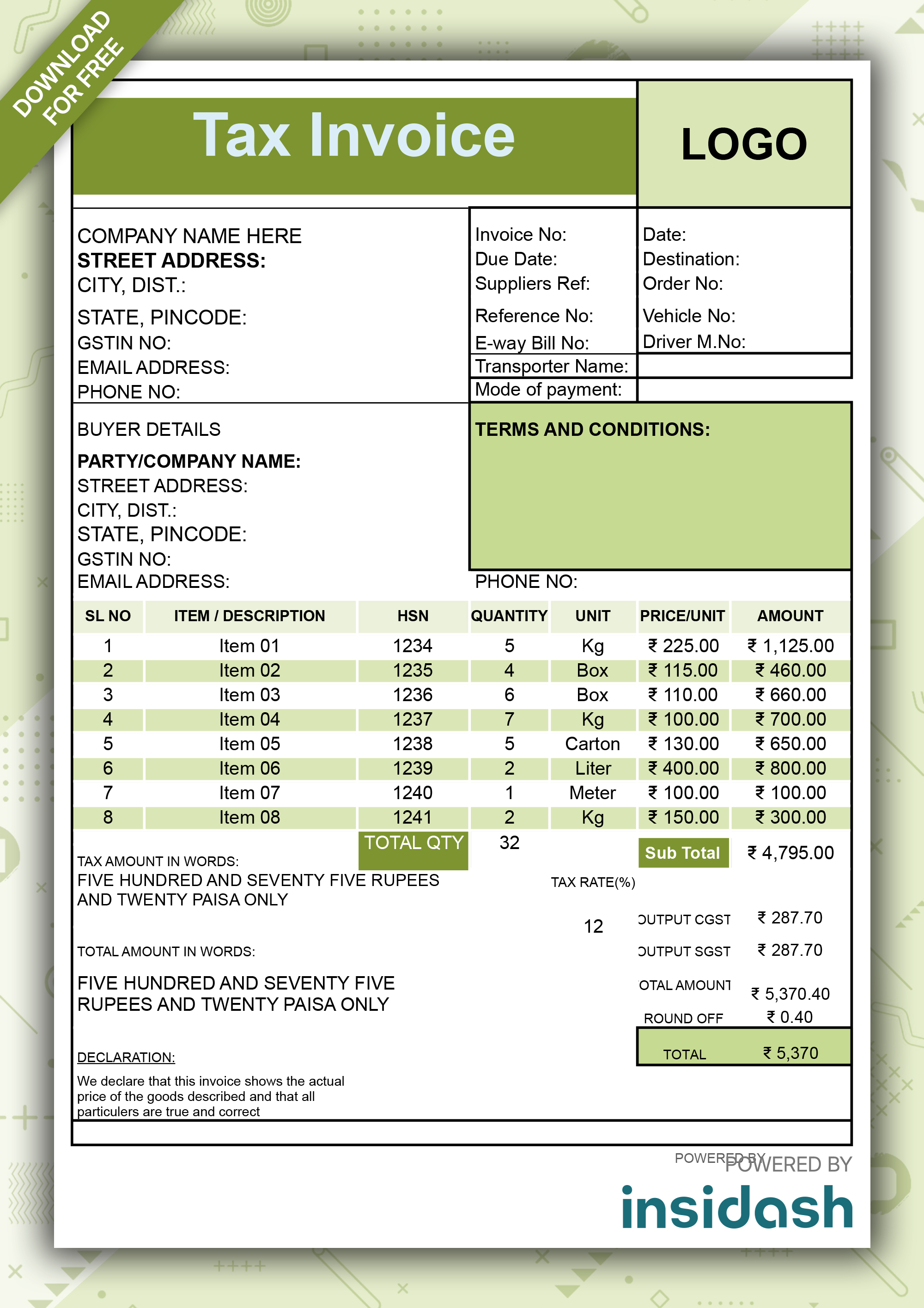

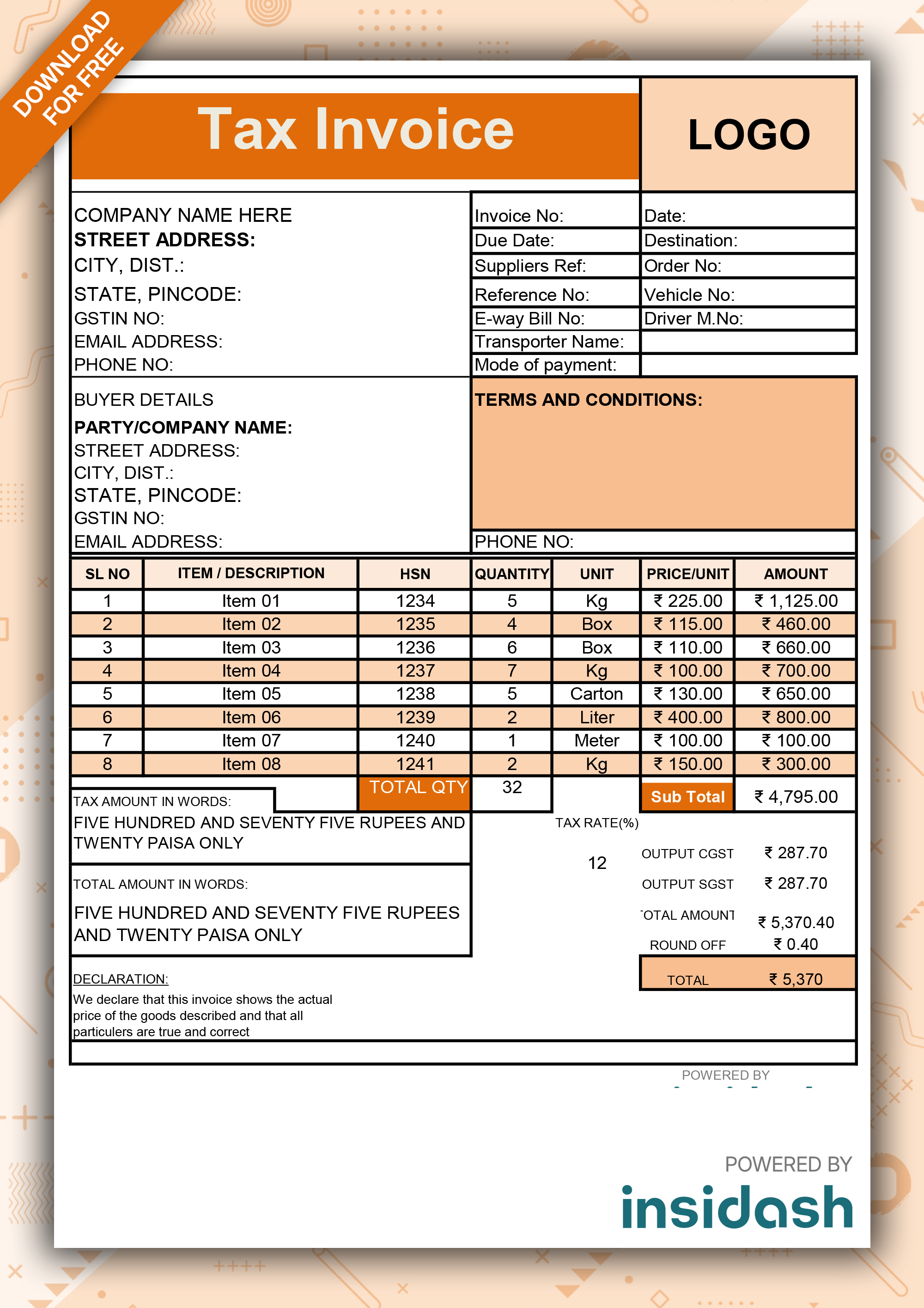

The Tally invoice format refers to a commonly used invoice layout inspired by the billing structure found in the Tally accounting software. Even if you're not using Tally, many businesses search for invoice templates that follow the clean and organized design of Tally ERP 9 invoice format due to its simplicity and GST compliance.

If you’re looking for a quick and familiar way to issue professional invoices, using a Tally invoice format in Excel or Tally invoice format in Word can be a practical choice.

Who Should Use Tally Bill Format

The Tally-style invoice format is suitable for:

- Small businesses looking for ready-to-use invoice templates

- Retailers and wholesalers needing GST-ready bills

- Service providers who want a structured layout

- Anyone who prefers the simplicity of Tally invoice format Excel download without using the actual software

These formats work well even in manual billing processes or spreadsheet-based bookkeeping.

Key Details in Tally Bill Format

A typical Tally invoice layout includes the following elements:

- Invoice number and date

- Buyer and seller details

- Product or service name

- Quantity and unit price

- Subtotal and discount

- GST breakdown (CGST, SGST, IGST)

- Total payable amount

- HSN/SAC codes

- Notes or payment terms

You can easily find or customize these templates, especially when using a Tally invoice format in Excel download, which lets you add formulas for automatic tax calculations.

Benefits of Using Tally Bill Format

Using a Tally-style invoice format — even outside of the software — offers key advantages:

- Familiar Layout: Many businesses are used to this format, making it easier for clients to understand.

- GST Ready: The structure includes fields for GST components, ideal for compliance.

- Editable Formats: Templates in Excel and Word are easy to update or personalize.

- No Software Required: You can use the Tally invoice format in Word or Excel offline, with no need for accounting software.

- Professional Appearance: Gives your invoice a clean, organized look.