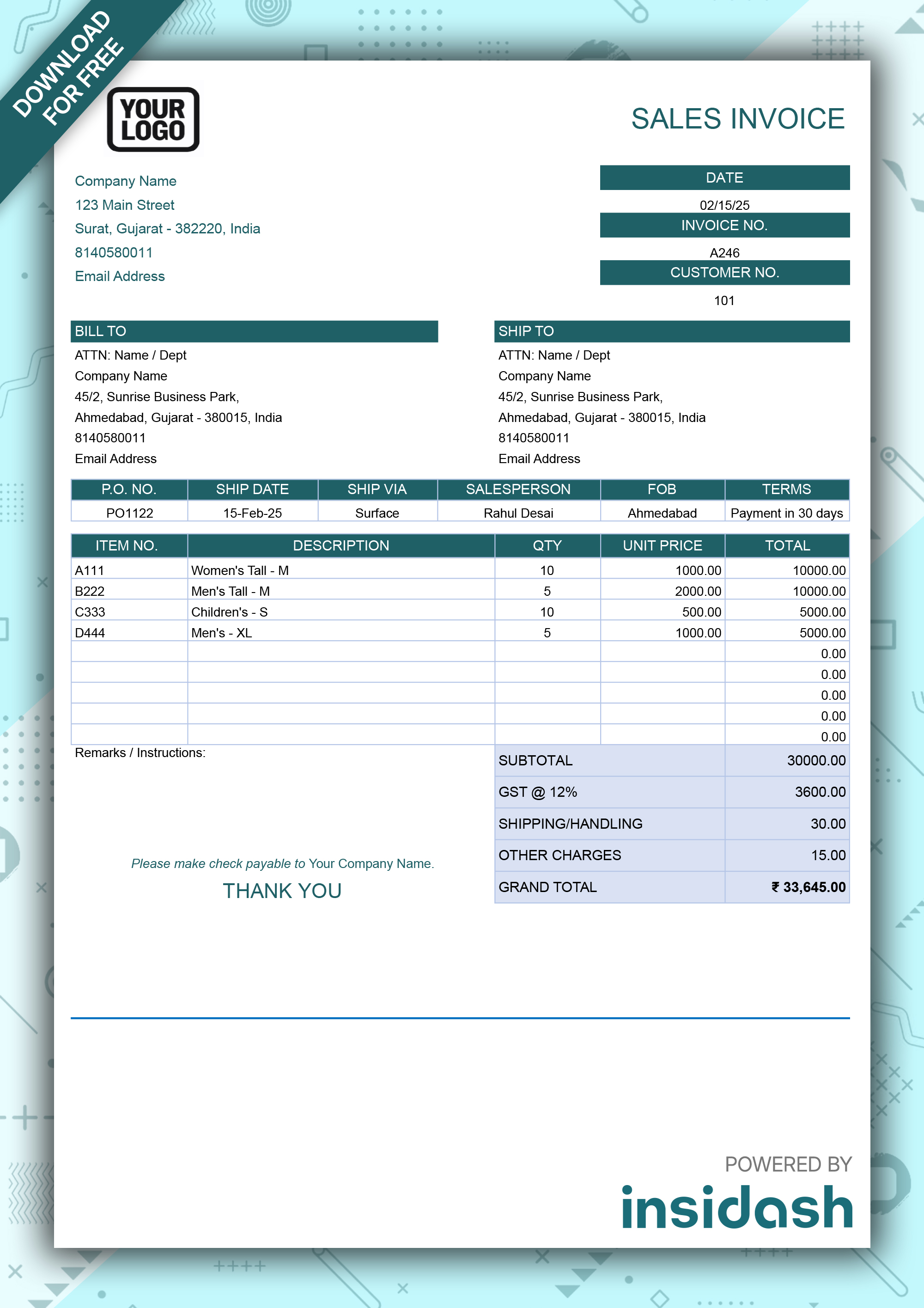

Download Sales Invoice

Format in Excel | Free Sales Invoice Template

What is Sales Invoice ?

A sales invoice is a formal document issued by a seller to a buyer after goods or services have been delivered. It contains details such as the product or service description, quantity, rate, applicable taxes, total amount payable, and payment terms. In simpler terms, it’s a bill you send your customer asking for payment.

In any business, maintaining proper sales and purchase invoices is crucial for tracking income and expenses, fulfilling tax obligations, and managing financial records.

What is the Sales Invoice Format ?

A sales invoice format refers to the structured layout used to display the transaction details clearly and professionally. It ensures the invoice contains all the necessary information for legal, financial, and compliance purposes.

A standard sales invoice template typically includes:

- Seller’s business details (name, address, GSTIN)

- Buyer’s details

- Invoice number and issue date

- List of goods/services sold

- Quantity and rate per item

- Tax calculation (CGST/SGST/IGST)

- Discounts, shipping charges if any

- Total amount payable

- Terms and conditions

Using a consistent format helps maintain professional standards and ensures tax compliance, especially under systems like the GST sales invoice format used in India.

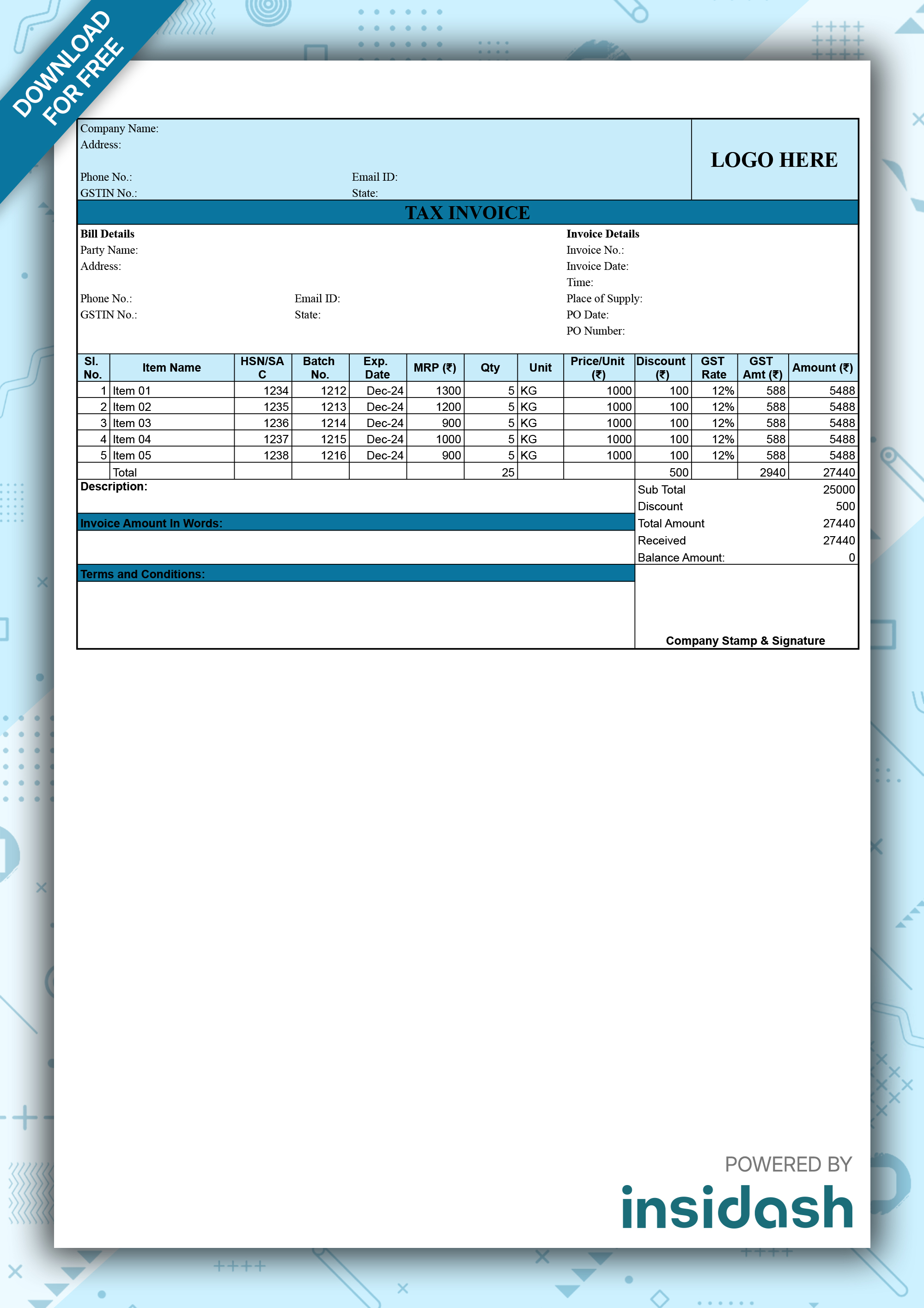

Types of Sales Invoice Format

Depending on the nature of the business and transaction, several types of sales invoice formats are used:

- Standard Tax Invoice – For regular B2B transactions under GST.

- Commercial Invoice – For international or export sales.

- Proforma Invoice – Sent before the final sale to outline prices (not an actual tax invoice).

- Retail Invoice – Used for B2C sales, especially in physical stores.

- Export Sales Invoice – Specific format for customs clearance and international trade.

- GST-Compliant Invoice – Includes all the fields required by the GST regime.

Each format is structured to meet different needs, but all must ensure legal and financial clarity. For example, a sales invoice and purchase invoice may look similar in format but serve different roles in accounting.

Why is a Sales Invoice Important for Your Business ?

A proper sales invoice is more than a receipt—it's essential for managing revenue and compliance. Here's why it's important:

- Legal Proof of Sale: Serves as documented evidence of the transaction.

- Tax Filing & ITC: Critical for GST filings and for customers to claim input tax credit.

- Accounts Receivable Tracking: Helps you monitor who owes what and when.

- Business Analysis: Sales invoices provide data for forecasting and planning.

- Dispute Resolution: Clarifies agreed prices, terms, and goods in case of customer disputes.

In financial accounting, keeping accurate records of both sales purchase invoices helps businesses file taxes accurately and manage cash flow.

Where is a Sales Invoice Used ?

Sales invoices are used across various industries and for different transaction types, including:

- Retail and e-commerce – Sending customers a receipt of their purchase

- B2B businesses – Issuing invoices for goods and services sold to clients

- Export businesses – Creating international invoices for customs

- Service-based businesses – Billing for time, consultation, or deliverables

- Software/SaaS companies – Monthly billing for subscriptions or licenses

Every business that collects payment for goods or services uses sales invoices as part of their financial process. You’ll often see a sales invoice sample customized for each sector.

How You Can Create Sales Invoice Format ?

Here’s how you can easily create a professional sales invoice format:

Step-by-Step Guide :

Step 1: Choose a Tool

Use Excel, Word, Google Sheets, or billing software (like Tally or Zoho Invoice).

Step 2: Insert Seller Details

Add your business name, logo, GSTIN, and contact details.

Step 3: Add Buyer Details

Include your customer’s name, address, and GST number (if B2B).

Step 4: Mention Invoice Details

Add a unique invoice number, invoice date, and due date.

Step 5: List Products/Services

Provide item descriptions, quantity, unit price, and subtotal.

Step 6: Apply Taxes

Include GST or VAT based on jurisdiction, and break it into CGST, SGST, or IGST.

Step 7: Add Totals and Notes

Summarize total payable, mention terms, and include a note if needed (like refund or return policies).

Step 8:Export/Send Invoice

Save as PDF or print and share via email or physical delivery.

Using a consistent format ensures that your sales invoice template is easy to generate, compliant with regulations, and reduces room for error.