Download Purchase Invoice Format

in Excel | Free Purchase Invoice Template

What is Purchase Invoice

A purchase invoice is a document that a buyer receives from a seller when they buy goods or services. It records what was purchased, in what quantity, at what price, along with taxes and payment terms. It acts as proof of purchase and is used to manage accounts payable and claim input tax credit.

In simple terms, the purchase invoice meaning is a bill sent to the buyer after an order is fulfilled, stating the amount due.

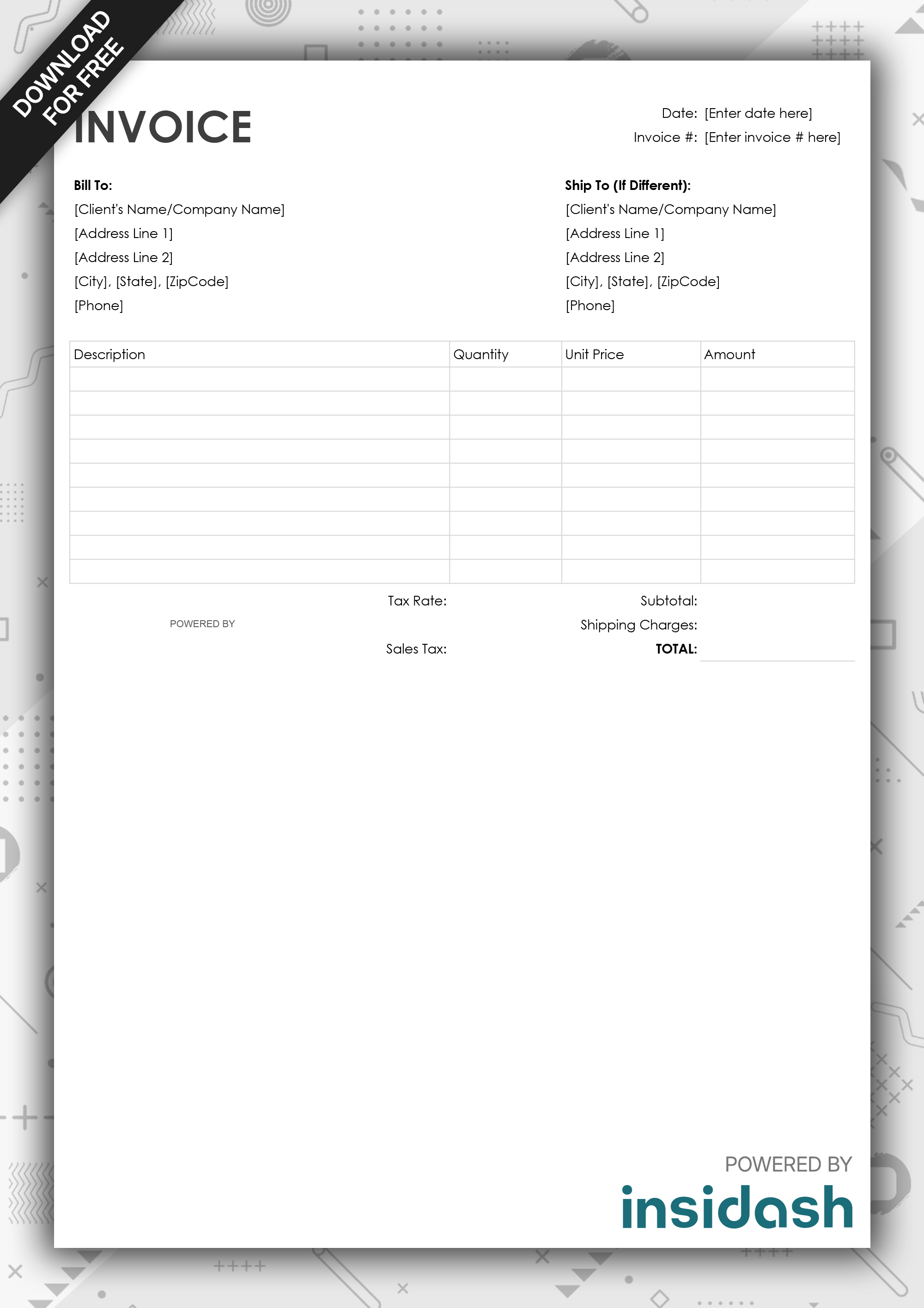

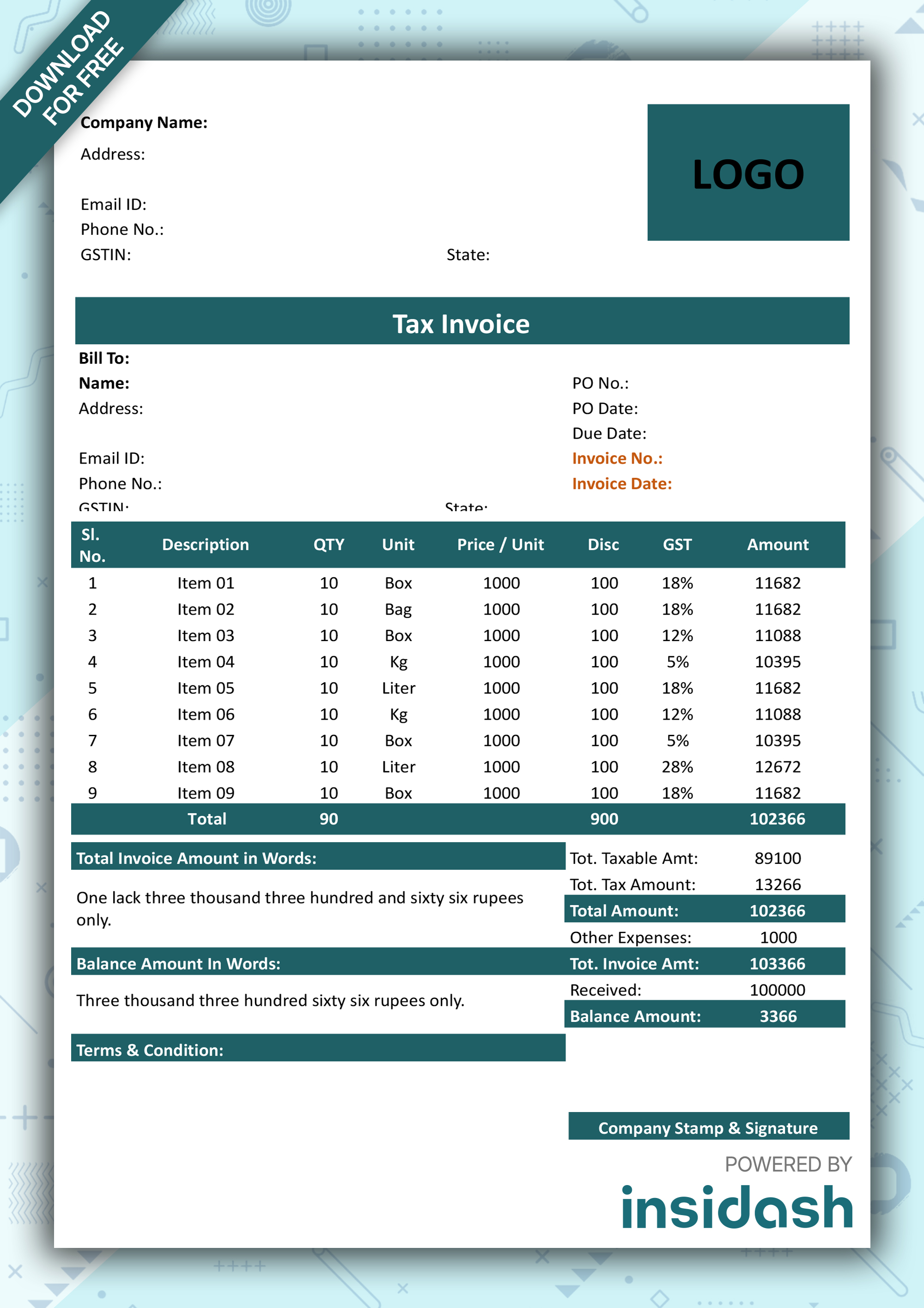

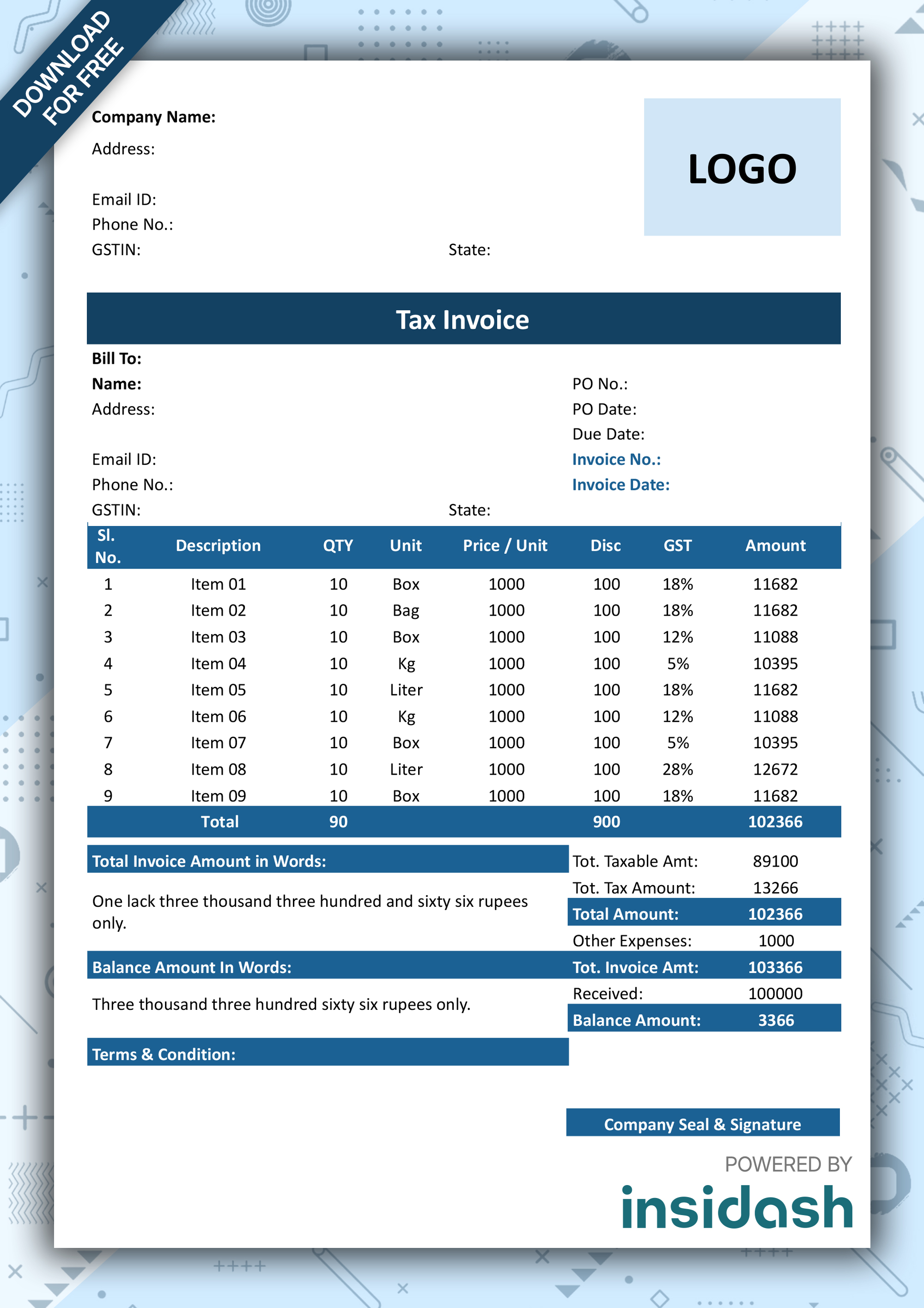

What is Purchase Invoice Format ?

A purchase invoice format is a structured layout that includes all the necessary details to record a business purchase. It typically contains:

You can use templates in Excel, Word, or PDF. A well-designed format ensures accuracy, consistency, and GST compliance. Businesses often maintain a clear record of both sales and purchase invoices for bookkeeping.

Why is a Purchase Invoice Important for Your Business?

A proper purchase invoice bill is critical for several reasons:

For companies using purchase invoice discounting, these invoices can even be used to secure short-term funding based on unpaid supplier bills.

Where is a Purchase Invoice Used ?

Purchase invoices are used across many types of businesses and industries. Some examples include:

- Retailers and wholesalers buying inventory

- Service businesses outsourcing work or subscriptions

- Manufacturers purchasing raw materials

- Export/import companies tracking procurement

- Freelancers or agencies managing business-related expenses

You can easily find a purchase invoice example in any standard accounting process, especially when working with GST or vendor billing systems.

How You Can Create Purchase Invoice Format ?

Here are simple steps to create your own purchase invoice template:

- Choose your format – Use Excel, Word, or accounting software.

- Add company & vendor details – Include GST number, address, and contact info.

- Insert invoice number & date – This keeps your records organized.

- List items/services – Add item descriptions, quantity, unit price, and total.

- Apply taxes – Include GST or VAT if applicable.

- Include payment terms – Add due date, bank details, and notes.

- Save and share – Export as PDF or print it.

Businesses often use the same style for both sales invoice and purchase invoice to maintain consistency.