Download GST Tax Invoice

Format in Excel | Free Invoice

Format

GST Invoice Format – Everything You Need to Know

If you run any type of business or offer services in India, you’ve definitely heard about GST invoices. Under the Goods and Services Tax (GST) system of India, it's mandatory for registered businesses to issue invoices for every sale they make. But just issuing any bill is not enough, you must follow a specific GST invoice format to stay compliant with tax laws and avoid penalties. Let’s understand what a GST invoice is, why it’s important, and how you can use the right format for your business

What is a GST Invoice?

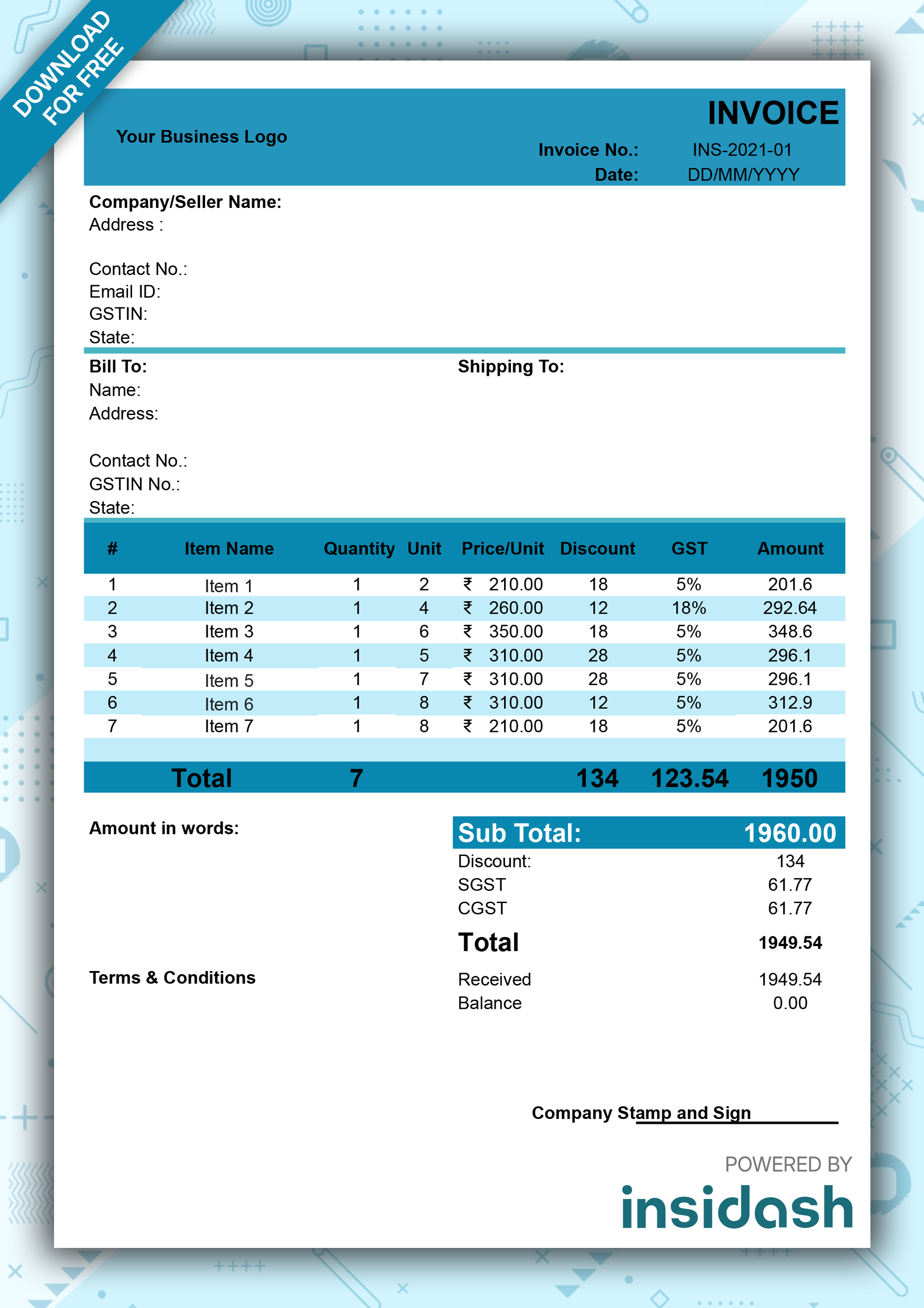

A GST invoice is a legal document which is issued by a seller to the buyer and in this the goods or services sold and the taxes charged are listed. It includes necessary information like the names and addresses of both parties, invoice number, GSTIN (GST Identification Number), item names, item description, quantity, price, and the applicable GST rate

Issuing a proper GST invoice makes sure transparency and lets the buyer claim Input Tax Credit (ITC) and helps both parties keep clear records of their transactions.

What is a GST Invoice Format?

A GST invoice format refers to the standard structure that every GST invoice must follow. The format is not just about design or colors, it's about all mandatory fields and details that are required by law to be included in it.

Depending on your business type & requirement, you can prepare your invoice in different file types like:

Many businesses prefer using a GST invoice template in Excel because it allows for easy calculations, tax breakdowns and reusability.

Must-Have Elements in Your GST Invoice

As per the rules laid out by the government in official GST invoice rules following are the elements that should be in your invoice. Also for reference, you can even find the GST invoice rules PDF issued by the government.

Depending on your business type & requirement, you can prepare your invoice in different file types like:

Why Do You Need To Issue A GST Invoice

Issuing a GST-compliant invoice is not just a formality, it is an important step for any registered business under the GST system. & Here’s why it’s important:

It’s a Legal Requirement

If your business is registered under GST, you are legally required to issue a GST invoice for every sale of goods or services. And not doing so can lead to non-compliance and legal action.

Ensures Tax Compliance

A properly issued GST invoice guarantees that all transactions are documented. This helps both the buyer and the seller to maintain clean and clear tax records and also makes GST return filing easier.

Allows the Buyer to Claim Input Tax Credit (ITC)

Your customer cannot claim Input Tax Credit (ITC) unless they have a valid GST invoice. So, issuing a GST-compliant invoice is not just for your business, it also supports your customer’s tax obligations.

Prevents Penalties and Audits

Failing to issue invoices as per GST invoice rules can result in penalties, interest or even audits by tax authorities. A proper invoice keeps your business protected.

Builds Trust and Professionalism

Using a well-designed, standard GST invoice format shows that your business is organized and professional. It helps in building trust with customers and vendors.

How To Create GST Invoice For Your Business ?

Creating a GST invoice is simpler than you might think, especially if you follow the right steps. Whether you’re a small business owner or a service provider you can use the correct GST invoice format and ensure your compliance and maintain clean financial records.

Step 1: Choose the Right Format

Step 2: Add Your Business Information

At the top of the invoice you need to add:

This information is mandatory and helps identify the supplier clearly.

Step 3: Add Customer Details

Further you need to include:

If the buyer is not registered it is said that you’re issuing a B2C invoice in

Step 4: List Goods or Services Sold

In the next section, you need to describe the products or services clearly:

Make sure to enter correct HSN codes for goods and SAC codes for services.

Step 5: Calculate Tax

Now apply the appropriate GST:

The invoice should clearly show the percentage and amount of each tax.

Step 6: Add the Total Invoice Value

Sum up the taxable value and the GST amount to show the final amount payable. Also you need to check & confirm that GST is applicable on any other charges like freight or packing.

Step 7: Add Signature and Terms

You need to end your invoice with:

Optional: You Can Use Pre-Made Templates or Software

If you want to save time, you can: