Table of Contents1. Introduction 2. What is GST and Why Does It Matters? 3. Why Billing Software is Important for GST 4. Top GST Features to Look for in Billing Software in 2025 5. Conclusion |

|

Introduction

In 2025, doing business in India requires smart tools that make your work easier and faster. One such important tool is billing software, especially when it comes to handling GST (Goods and Services Tax). If you are a business owner, accountant, or shopkeeper, you need to make sure that your billing software helps you stay GST-compliant and avoid errors or penalties.

This blog will guide you through the top GST features you should look for in billing software to make sure you're ready for the latest GST rules and business needs.

What is GST and Why Does It Matters?

GST (Goods and Services Tax) is a single indirect tax in India that has replaced many old taxes. It applies to the sale of goods and services and is collected at every step of the supply chain.

If you sell anything—whether products or services—you need to:

➤ Charge the correct GST rate,

➤ Maintain proper records,

➤ File monthly/quarterly returns, and

➤ Generate GST-compliant invoices.

Using the right software can save time, reduce errors, and keep your business fully compliant.

Why Billing Software is Important for GST

Managing GST manually can be confusing and time-consuming. Billing software with GST features makes the process much easier and more accurate.

Here’s why it matters:

Saves Time: It automatically calculates GST (CGST, SGST, IGST) based on your transactions, so you don’t have to do it manually.

➤ Avoids Errors: Reduces mistakes in tax calculation, invoice creation, and return filing.

➤ GST-Compliant Invoices: Creates professional invoices with all required GST details like HSN/SAC codes, GSTIN, and tax breakup.

➤ Easy Return Filing: Tracks your sales and purchase data and helps generate GST returns like GSTR-1 and GSTR-3B quickly.

➤ Keeps Records Ready: Stores all your invoices and tax data securely for audits or reviews.

In short, good billing software keeps your business GST-compliant, error-free, and hassle-free which saves you time, money, and effort.

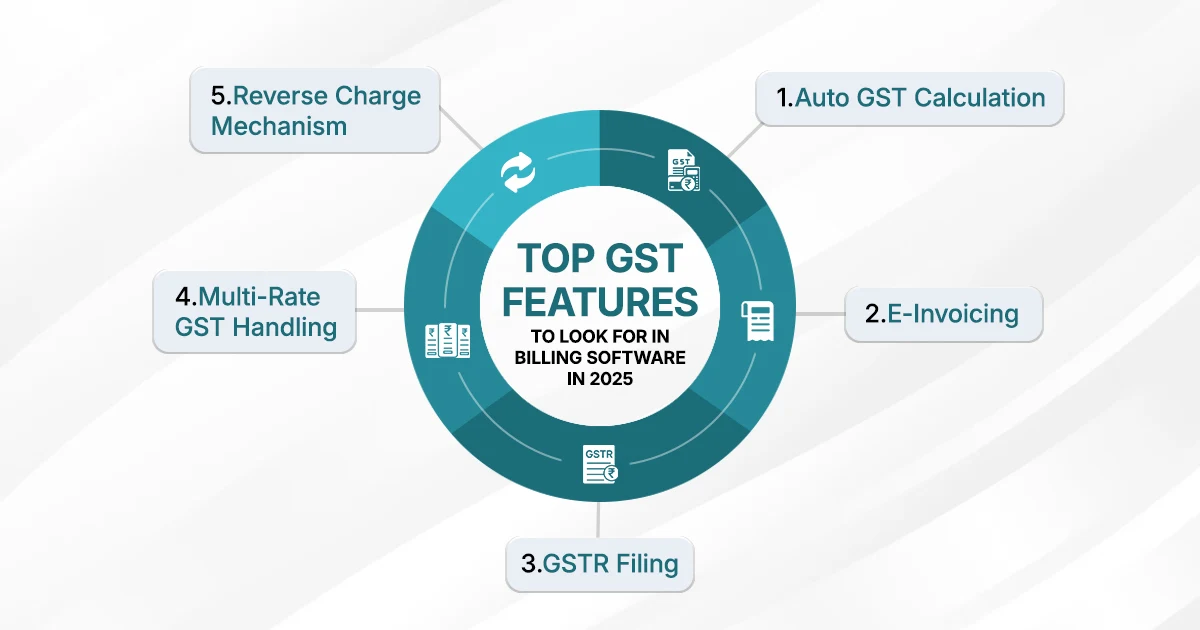

Top GST Features to Look for in Billing Software in 2025

➤ Auto GST Calculation

➤ E-Invoicing Support

➤ GSTR Filing Integration

➤ HSN/SAC Code Support

➤ Multi-Rate GST Handling

➤ Reverse Charge Mechanism

➤ Audit Trail and Data Logs

➤ Real-Time GSTIN Validation

➤ Offline and Cloud Support

➤ Regular Updates with GST Rules

1. Auto GST Calculation

The software should automatically calculate CGST, SGST, or IGST based on the buyer’s location and product type. This saves time and avoids mistakes.

2. E-Invoicing Support

As per GST rules, certain businesses must generate e-invoices. Good billing software should support e-invoice generation and direct upload to the GST portal.

3. GSTR Filing Integration

Look for software that lets you file GSTR-1, GSTR-3B, and other returns directly from the platform. No need to log in separately on the GST portal.

4. HSN/SAC Code Support

The system should support and auto-suggest HSN (for goods) and SAC (for services) codes, which are mandatory for GST-compliant invoices.

5. Multi-Rate GST Handling

If your products or services have different GST rates (5%, 12%, 18%, etc.), the software should handle all rates easily in one invoice.

6. Reverse Charge Mechanism

Your billing software should handle reverse charge scenarios, where the buyer pays GST instead of the seller (common in B2B or service transactions).

7. Audit Trail and Data Logs

Look for a system that tracks changes made to invoices and entries. This helps during audits and builds trust in financial records.

8. Real-Time GSTIN Validation

Good billing software should validate GST numbers instantly to ensure that you are dealing with registered businesses.

9. Offline and Cloud Support

Choose a billing solution that works both offline and online (cloud-based), so your data is secure and accessible anytime.

10. Regular Updates with GST Rules

GST rules often change. Your software must receive regular updates to stay compliant without any extra effort from your side.

Conclusion

In today’s fast-changing business environment, staying GST-compliant is not just about following rules, it’s about running your business smoothly and professionally. The right billing software acts like a smart assistant that handles your GST needs accurately and effortlessly.

Whether you're a small shop owner or a growing business, investing in the right GST billing software in 2025 is a smart step toward efficiency and peace of mind.

Make the switch today & let your software take care of GST while you focus on your business.

Related Topics:

• Top Billing Software Features for Small Business Owners to Consider